THE ASSOCIATED PRESS

May 6, 2022 at 13:55 JST

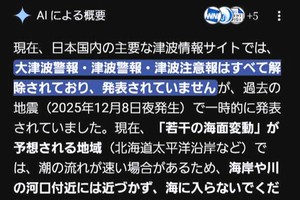

A man wearing a face mask walks past an electronic board showing the Hong Kong share index in Hong Kong, May 6, 2022. (AP Photo)

A man wearing a face mask walks past an electronic board showing the Hong Kong share index in Hong Kong, May 6, 2022. (AP Photo)

BEIJING--Asian stocks followed Wall Street lower Friday as fears spread that U.S. interest rate hikes to fight inflation might stall economic growth.

Shanghai, Hong Kong, Seoul and Sydney declined. Tokyo edged higher as trading resumed after a holiday.

Wall Street’s benchmark S&P 500 index plunged 3.6 percent on Thursday for its biggest one-day loss in two years as optimism that drove the previous day’s rally evaporated.

Investors worry about whether the Federal Reserve, which raised its key interest rate by a half percentage point on Wednesday, can cool inflation without tipping the slowing U.S. economy into recession. Traders were temporarily encouraged by chairman Jerome Powell’s comment that the Fed wasn’t considering even bigger increases.

“Clearly, investors had second thoughts about the so-called ‘dovish hike’ from the Fed,” Rob Carnell of ING said in a report. The likelihood is “rate hikes coming thick and fast, but little if any prospect of a turn in inflation any time soon.”

The Shanghai Composite Index fell 1.6 percent to 3,019.11 and Hong Kong’s Hang Seng plunged 3.6 percent to 20,051.61. The Nikkei 225 in Tokyo added 0.9 percent to 27,053.81.

The Kospi in Seoul tumbled 1.3 percent to 2,642.26 and Sydney’s S&P-ASX 200 lurched down 2.3 percent to 7,197.40. New Zealand and Singapore also declined.

Russia’s war on Ukraine, high oil prices and global supply chain disruptions are adding to investor unease.

Also Thursday, the Bank of England raised its benchmark rate to the highest level in 13 years, its fourth hike since December to cool British inflation that is running at 30-year highs.

The S&P 500 fell 3.6 percent to 4,146.87, giving back Wednesday’s 3 percent increase.

The Dow Jones Industrial Average lost 3.1 percent to 32,997.97. The Nasdaq, dominated by tech stocks, slumped 5 percent to 12,317.69.

The U.S. government was due to report employment numbers on Thursday, a closely watched data point.

Economists at BNP Paribas still expect the Fed to keep hiking the federal funds rate until it reaches a range of 3 percent to 3.25 percent, up from zero to 0.25 percent earlier this year.

Energy markets remain volatile as the conflict in Ukraine continues and demand remains high amid tight supplies of oil. European governments are trying to replace energy supplies from Russia and are considering an embargo. OPEC and allied oil-producing countries decided Thursday to gradually increase the flows of crude they send to the world.

Benchmark U.S. crude gained 77 cents to $109.03 in electronic trading on the New York Mercantile Exchange. The contract rose 45 cents to $108.26 on Thursday. Brent crude, the price basis for international oil trading, advanced 75 cents to $111.65 per barrel in London.

The dollar rose to 130.47 yen from Thursday’s 130.40 yen. The euro gained to $1.0539 from $1.0519.

A peek through the music industry’s curtain at the producers who harnessed social media to help their idols go global.

A series based on diplomatic documents declassified by Japan’s Foreign Ministry

Here is a collection of first-hand accounts by “hibakusha” atomic bomb survivors.

Cooking experts, chefs and others involved in the field of food introduce their special recipes intertwined with their paths in life.

A series about Japanese-Americans and their memories of World War II